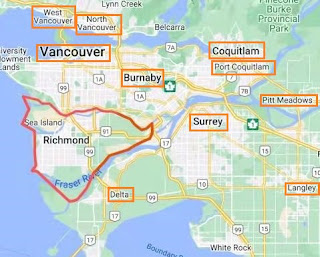

Richmond Real Estate Market

Richmond is an island city. It is made up of a number islands in the Fraser River delta. It is just one meter above sea level. It was prone to flooding, especially during high tide. Therefore, major islands are now surrounded by a system of dykes, which serve to protect the town. Also, since it occupies land in a river delta, the city has plenty of rich soil for agriculture. Richmond is a culturally unique community. As of 2021, the city has an estimated population of 209,937 people with 60 percent being immigrants, the highest proportion of immigrants in Canada. Majority of immigrants are Chinese. Richmond has been experiencing growth and change, transforming from a rural, local community to an international city with a balance of urban, suburban family and rural areas. The city is 20 minutes from downtown Vancouver and 25 minutes from US border. It’s the location of Vancouver’s international airport. The SkyTrain, Canada Line, speeds up transit system and connects Richmond to other