Richmond Real Estate Market

People have to pay property transfer tax when they buy a

property. This would be added to the purchase price. The property transfer tax is

based on the fair market value of the property. The rate is :

For example: fair market value is $3,500,000, tax payable

would be:

Total property transfer tax: $2,000 + $36,000 + $30,000 +

$25,000 = $93,000. More detail, please visit https://www2.gov.bc.ca/gov/content/taxes/property-taxes/property-transfer-tax/calculation-examples

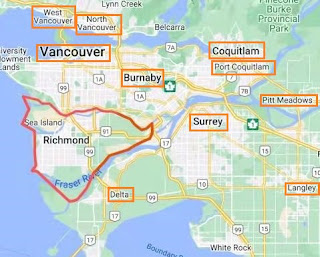

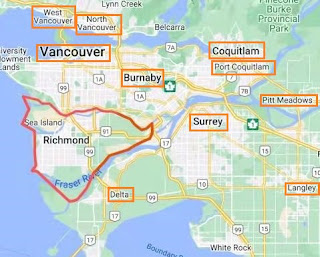

There is an additional tax applied for foreign nationals, foreign corporations, and taxable trustees in the Capital Regional District,

Fraser Valley Regional District, Metro Vancouver Regional District, Regional

District of Central Okanagan and Regional District of Nanaimo. The additional tax does not apply to Tsawwassen

First Nation treaty lands. The tax rate is 20% of the fair

market value.

Comments

Post a Comment